VA Home Loan Basics - Military OneSource - Truths

See This Report on VA Loans - Loans & Mortgages - Armed Forces Bank

Kinds Of VA Loans The VA uses numerous types of mortgage: Home Purchase Loans VA home purchase loans assist veterans to buy a home at a competitive rates of interest. These purchase loans typically do not require a deposit or personal home mortgage insurance coverage. Cash-Out Refinance Loans Cash-out refinance loans permit mortgage holders to obtain versus home equity to pay off debt, fund school, or make house enhancements.

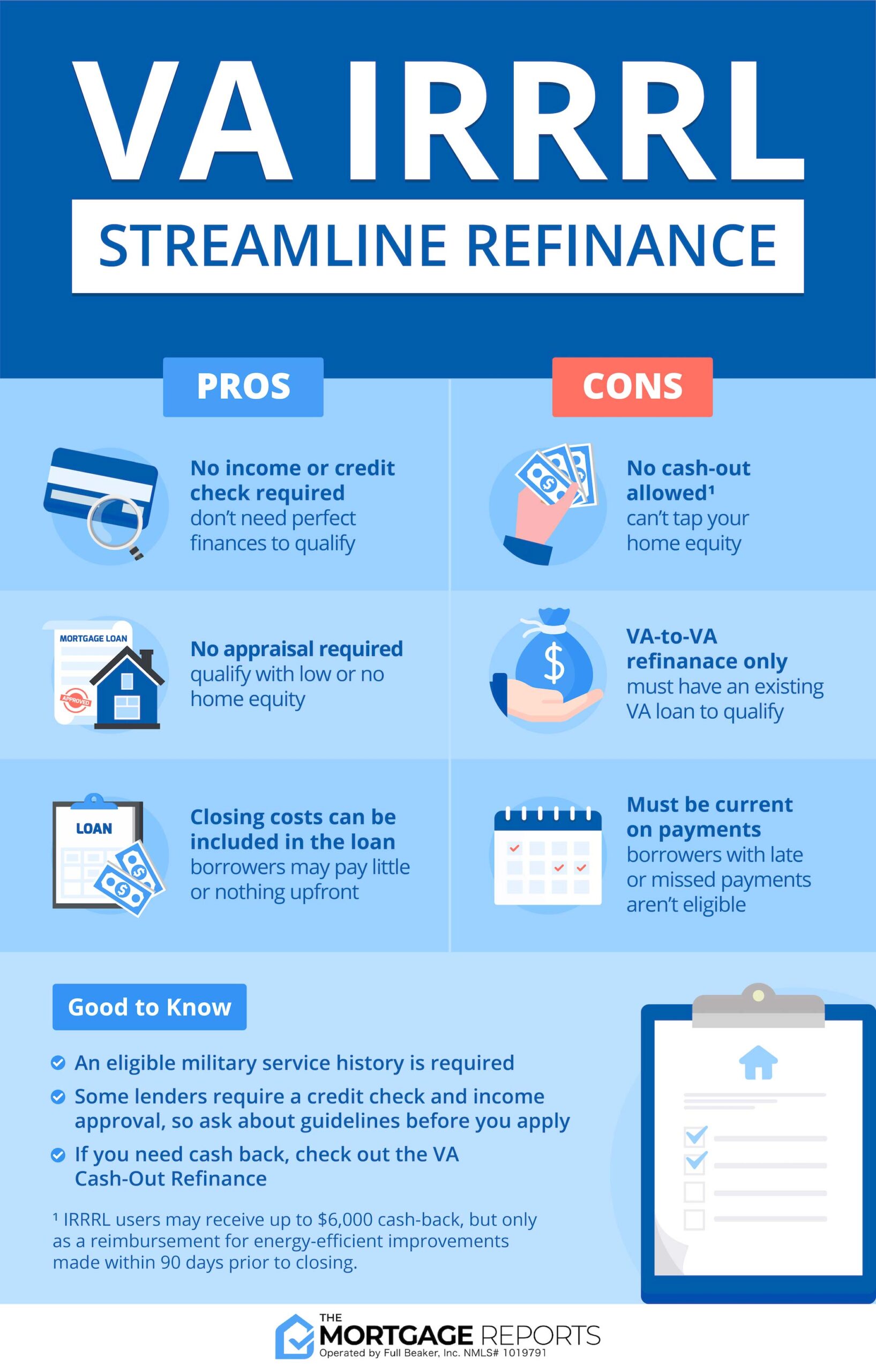

The VA likewise offers adapted housing grants. These grants help veterans with a long-term and total service-connected impairment to buy or build an adapted house or customize an existing house for their disability. A Good Read Of Interest Decrease Refinance Loan Interest rate reduction re-finance loans (IRRRLs), likewise referred to as VA improve refinance loans, assistance debtors get a lower rates of interest by refinancing an existing VA loan.

Native American Direct Loan The Native American Direct Loan program assists qualified Native American veterans fund the purchase, construction, or enhancement of homes on federal trust land. Decreases in interest rates likewise come with these loans.

VA Loan Limit Rules - Military Benefits

VA Loans: A Complete Guide - 2021 Requirements & Eligibility

See This Report on VA Home Loans - VA Loans for Military & Veterans - AAFMAA

When you have actually validated that you satisfy the service requirements for a VA loan, you require your income, possessions and credit to take a look at, along with the residential or commercial property you're buying. Home Type VA loans can likewise be used on condominiums and manufactured houses, but not all lenders will finance loans for these home types.

The property you buy need to be your primary house within 60 days of purchase. You can't use a VA loan for a trip or investment home, however you can utilize it to purchase a one-to-four family home if the eligible member uses it as a primary residence. Credit Rating The VA doesn't require a specific minimum credit rating for VA loans, so the credit requirement differs by lender.

Military Housing Loans for Current Service Members

Income Your lending institution will assess your debt-to-income ratio (DTI) when considering your ability to pay back the loan. Your DTI represents just how much of your monthly income goes towards paying back financial obligation. The VA does not set limits on your DTI, although some lending institutions might. VA Loan Limit The VA does not restrict just how much you can borrow, however there is a cap on the VA's guarantee.